Will I Get My Deductible Back? Car Damage and Illinois Law

Photo: Car insurance policy with pen and dollar banknote by Marco Verch under Creative Commons 2.0

Not everyone has extra money lying around that they can use to pay the deductible after an accident. And while minor repairs could be postponed, a more serious wreck might make the car undrivable, leaving you without a way to even get to work. There is often little choice other than scraping together the deductible amount and filing an insurance claim for the rest of the repairs to fix the property damage. Accident victims wonder “Will I get my deductible back?” Luckily, in Illinois, there’s a good chance you can.

What is the Purpose of a Deductible?

Chart courtesy of Maryland Health Benefit Exchange

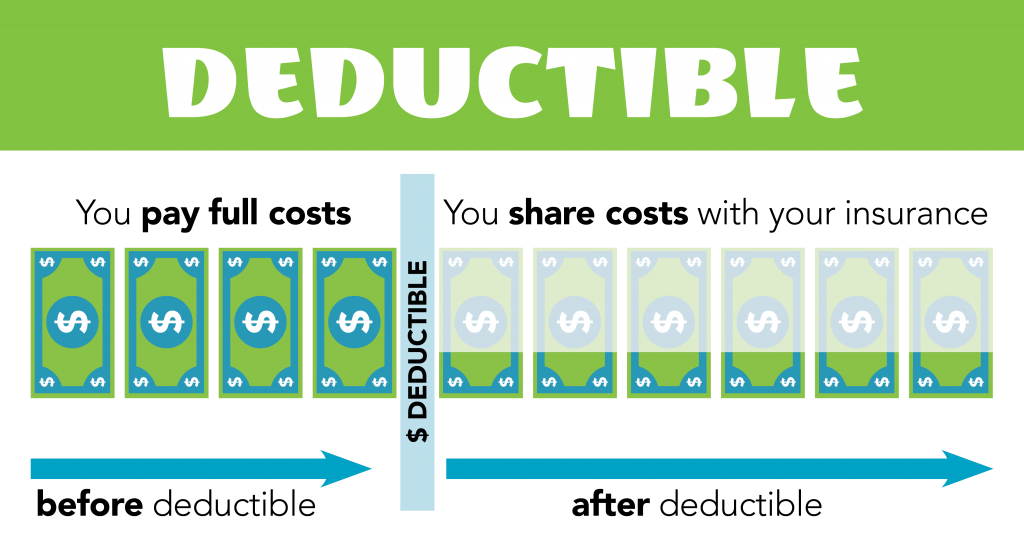

Most car insurance policies include a deductible. This is a set amount that the insured person must pay out of their own pocket if they have an accident. The insurance company will cover costs over that amount up to the insurance policy limit. For example, let’s say a car sustains $1500 worth of damage. If the driver has a $500 deductible, they are responsible for paying that much to the repair shop and the insurance company will cover the remaining $1000.

The purpose of a deductible is to have the driver share some of the risk associated with an accident. No one plans to have an accident, so many people opt for a higher deductible in return for lower premiums. If they never have a wreck, they’ve saved money. Unfortunately, if they do get in a crash, it will cost them more out-of-pocket. Some insurers offer zero-deductible policies for those willing to take on very high premium payments.

Choosing a deductible amount is somewhat of a “pay now or pay later” scenario. In the event of an accident, someone who has been paying lower premiums will now have to find the funds to cover the deductible before their car can be fixed. And the deductible must be paid for each incident, so for someone unlucky enough to get in a lot of wrecks, the costs will add up.

How a Car Insurance Claim Works

Photo courtesy of franchiseopportunities.com

When a car is damaged in an accident, the driver can file a claim with his or her insurance company to fix it. The insured pays their deductible amount to the repair shop (or sets up a payment plan if they can’t afford it) and the insurance company pays the shop the rest.

If another driver caused the accident, the insurance company will go through a process called subrogation. Subrogation is the legal right of the insurance company to collect money from the party at fault.

This means that after the insurance company pays their insured for their damages, they then go to the at-fault driver’s insurance company to demand reimbursement. Subrogation happens behind the scenes between the two insurance companies. The drivers do not get involved in these negotiations.

Recovering a Deductible

When an insurance company attempts to “subrogate its loss” from a third party, it asks for the amount that was paid out in damages to the insured, plus the amount of the deductible. When they collect it, they then reimburse the deductible amount to the insured. The insured will need proof of their out-of-pocket expenses, so it’s important to keep receipts of all payments that went toward the deductible.

In Illinois, an insurance company is required by law to include the amount of the deductible in any subrogation action. But each state has its own subrogation rules when it comes to reimbursing deductibles. For example, in neighboring Missouri, the person filing the claim must request that the insurance company include the deductible amount in any subrogation negotiations. It’s important for a driver to ask about his or her state’s rules when making an insurance claim, or they may miss the chance to get their deductible back.

Times That You Can’t Get Back Your Deductible

The previous scenario assumes that there was another driver who caused the accident, making them (and their insurance company) liable for paying damages. In other circumstances, the out-of-pocket deductible can not be recovered, namely, if there was no other driver, or if the insured was the one at fault.

Let’s say someone is driving on an icy road and slides into a guardrail. They aren’t hurt but their car is damaged. Their insurance company will cover the cost of fixing the car (up to the amount of coverage) after they pay the deductible amount themselves. In this case, there is no other driver involved, so there is no one for the insurance company to go to recoup its losses. The driver, therefore, will not get any reimbursement for the deductible.

Another case when a driver will not be eligible to recover his or her deductible is if they are the one that is at fault in the accident. In fact, it is their insurance company that will be responsible for reimbursing the victim’s deductible during subrogation.

Why You Might Not Get Back All of Your Deductible

There are situations when an insured person might get some of their deductible payment back, but not the full amount.

Incurred Expenses. In Illinois, if an insurance company has spent money to subrogate a specific claim, those expenses can be deducted from the deductible reimbursement. These could include the cost of an attorney, collection agency, or insurance adjuster that they hire for that case. They can not, however, reduce the reimbursement for administrative costs that they would have incurred no matter what—like office supplies or their receptionist’s salary. In Missouri, only an outside attorney’s fees can be deducted as an incurred expense.

Pro-Rata Settlement. Let’s say an insurance company tries to recover what they paid an insured driver, but the at-fault driver only carried enough insurance to cover 80% of that amount. If the insurance company settles for 80% of the total, the victim will only receive 80% of his or her deductible. One way around this is to carry uninsured or underinsured motorist coverage. This gives the driver a better chance of getting full compensation for all of their losses.

Comparative Negligence. If the insured driver is partly at fault for the accident, they may only be able to get part of their deductible back, depending on the state where they live. Illinois is what is called a modified comparative negligence state. This means that if one driver is more at fault than another, he or she is liable for the entire amount of the claim. So, in Illinois, this means the victim could get back 100% of the deductible, even if they were partly to blame for the crash.

Missouri, however, is a pure comparative negligence state. This means that if two drivers share the blame, they also share the liability. For example, if Driver A is found to be 25% at fault and Driver B is 75% at fault, Driver A will only be able to collect 75% of the total damages. This goes for the deductible too. If Driver A’s deductible was $1000, the most he or she will recoup is $750.

Protecting Your Interests to Get Back Your Deductible

Finding out no one is hurt after a car accident is very good news. So is knowing that your insurance will cover your car’s damage. Having to pay the deductible? That’s the not-so-good news, especially if you’re strapped for cash.

Even with good insurance coverage, car accident claims can get complicated. It’s a good idea to contact a St Louis car accident attorney. They are experienced in cases involving auto insurance and property damage and can help you get the compensation you deserve, including getting your deductible back.

Category:

Tags:

car accident, car accident claims, insurance, insurance deductible